Sorry for the deafening silence, my flock. I've been tied up trying to re-file my 2006 taxes. I knew the code was labyrinthine and ridiculous, but now I have a deeper appreciation for that characterization. In years past I have always channeled my trades through a business entity or at least used an accountant. But last year I essentially reported my trades as a non-professional customer and I tried to hammer out the forms myself. I made several mistakes and the IRS took notice.

Otherwise, I have been trying to recover from a serious loss I took trying to catch the falling NASDAQ knife. I actually came in really short to start the year but, of course, got flat too early, and then long too soon and too much. As of now I have dumped the position and am chipping away at the deficit.

Today I dumped

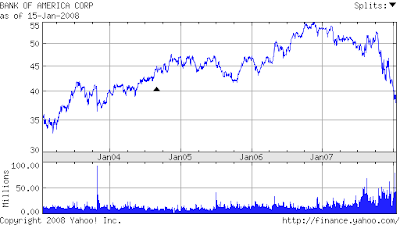

Newmont Mining and shorted both

Bank of America and

Capital One Financial (at 54.90, 41.77, and 51.69 respectively). Newmont has actually been a core holding for a while; the mere seven points I made on it will at least get filed as a long term gain (before the AMT kicks it to 21%, effectively a higher tax rate than I would have paid a few years ago with a 20% capital gains rate.)

Gold has exploded and Newmont has barely budged. Reasons for this under-performance abound: higher production costs (think oil and electricity), political extortion, problems replacing reserves, etc. It suffices to say that in hindsight, I should have bought the physical metal in lieu of Newmont shares. I did make some good money in the stock over the last several months: I bought the Jan70 calls at 1.50 and sold them at 4.00, I flipped the June50 calls, and I scalped the stock a few times.

In fact, Newmont was one of the first stocks I ever traded. Back in 1996, gold was $385 per ounce and NEM was $60 a share. Today, gold has rallied to $920 an ounce and Newmont is merely $55. That is some serious underperformance over a 12 year period and it reminds us of Jim Rogers' assertion that mining shares have been the "worst" sector to invest in throughout the history of the stock market.

Just about all I have left in my account besides

Google (bought some more today at $550) is a sizable position in

Coeur d'Alene, a silver mining concern. I own the stock and January calls (both the 5s and 7.5s). That's another mining position that has pathetically underperformed the precious metals.

I've been pretty much cleaning house in my trading accounts. Gone are my

commodity positions that I promised to "never sell": cocoa, coffee, sugar, and cotton. I also covered my short

euro position. I actually got out at a great price on MLK day when just about all the domestic markets were closed. If you remember, the Dow futures were trading down 550pts that night. Pretty much the only reason I covered my short euro was to free up some capital for what was going to be a most volatile Tuesday morning. If you recall, I got short at 1.47; rode a loss up to 1.49; then was fortunate to cover at 1.4433.

That euro unwind worked out great as the euro has since bounded back to 1.4755 and I was able to buy the Dow futures early Tuesday morning down 550 points. Not even a couple of hours hence, the Fed predictably made a "surprise" 75 basis point cut in the Federal Funds Rate - and I dumped my Dow Futures for a most rapid 274 point profit!

This is the story of my career. I get killed on my large bets but clean up on the little ones. However, my account purging has been more deliberate than distressed. There's simply so much intraday volatility that I want to take advantage of. In these times, it's best to play it small and nimble. With all this trading opportunity, one doesn't have to swing much of a bat to make $$$$.

These days, I would LOVE to see a big financial stock rally so I could short the lot of them. Selling into financial rallies is and will be one of my game plans for the foreseeable future. Now enough of this boring stock market stuff

Do you watch HGTV?

I admit I watch it aplenty these days. Usually I tape the shows and cruise through them to see the conclusions. Did they buy the cheap house or the one "over their budget"? I also like to see the fruits of "updating".

My wife is less tolerant of some of these shows - and she has a point. Who the (blank) vets a mere three homes and then buys one of them? I'd look at twenty before I even signed a rental agreement!!!

The other day they had on some newlywed couple in Colorado who left their rental (replete with roommates) to "buy" a mountain house for around $210,000. They said they were anxious to stop "wasting money on rent". So what did they do? They bought with 100% financing and a 5-year interest-only loan at 6.87%. They went the interest-only route to "keep the payments down". So after paying $1,400 a month for 60 months - a total of $84,000 - their loan will need to be refinanced at prevailing rates AND they will obviously have zero equity.

So much for not "wasting money"...

Does this sound like anyone you know?

There's another show on HGTV called "My House Is Worth What?" with a most insane premise.

In a nutshell, here's the show - some idiot homeowners guess what their house is worth and then, a real estate agent comes in to give their own best estimate.

The discrepancy between the two "guesses" is mostly a function of the homeowner's ignorance, the real estate agent's perma-optimism, and of course, the current state of the housing market.

It'll be fun to watch the reruns of this show as the housing debacle drags on for years. For example, "Joe and Susie paid $750,000 for this bungalow in Miami. They put about $100,000 more into it...and now, only 6 months later, it's worth $1.5 million!"

That was definitely how the show started out a year or so ago. Now it'll be Joe and Susie's $850,000 investment is on the market for $700,000. Ouch.

Incredibly, this show is mostly about home equity loans. The inquiring homeowner wants an appraisal because they want to take out money to either do an addition or renovate kitchens, baths, and basements. They want to know if they will "get the money back" that they plan on borrowing and "investing" into the house.

It's an insane line of thinking:

My house is worth 500k and I only owe 400k. If I take out 75k to redo the kitchen, my house will be worth at least 575k, so it's a good investment.Bullsh*t. Renovations should be seen more like SUNK COSTS because you pay interest on the home equity loan and because as you enjoy them, they DEPRECIATE. In fifteen years, your 75k kitchen will be dated; so figure that depreciates at a tune of $1,000-$3,000 per year. Home equity loans amount to borrowing against the future for present consumption. THEY ARE NOT INVESTMENTS.

In fact, today in the marketplace, bonds backed by home equity loans are quite distressed. Largely due to their status as secondary liens, HELOCs are currently trading at pennies (20?) on the dollar. In other words, the primary mortgage owner has first dibs on a foreclosed home and the second dibs, these days, are worth almost nothing.

I wouldn't recommend taking out a home equity loan for renovation UNLESS one had a boatload of equity or sufficient cash on hand to pay off the loan. I just don't get the idea of BORROWING for present consumption. It's this mindset that's made America a nation of debt slaves.

How's this for a radical concept -

If your basement costs ten grand to finish....then DON'T DO IT until you have ten grand saved up!!!

This weekend, for kicks I walked through the above "open house". It's been for sale for 200+ days and was recently lowered from $1.7 million to $1.159. It's "relo-owned". Meaning some company moved an executive and essentially bought his house from him. In this case, Frito-Lay is the new homeowner - and they can't be too happy about it.

It's a gorgeous 4,800 square foot home and it's only a few years old. It's way too much house (and money) for me. Taxes are $14,000 a year and when I asked about the heating bill I received this doozie from the realtor,

Realtor -

This house is tight. The heating bills weren't bad at all. Only five thousand last year.CaptiousNut - (laughing). Only five grand huh? Last year was one of the warmest winters on record and oil was nearly 40% cheaper.

What a

Moron!

Or, she must think I'm a

Moron.

Lemma -

Housing prices will go back to 1998 levels.You think I am crazy, right?

About now, generally speaking, we are nearing 2003 averages. My

Lemma is based on the fact that carrying costs are much higher now than they were ten years ago. Property taxes have only been rising; insurance premiums are higher; and utility bills have exploded. Sure, incomes are up, but we'll see how long that lasts.

It's my contention that people across the land STILL underestimate the total costs of homeownership. For example, in this day and age, Americans change jobs all the time. And despite

CraigsList and FSBO options, it still costs about 5% to sell one's house. So add on to the higher carrying costs of today's homes, what I submit are higher transaction costs. If people sold one home every thirty years before, I'll bet they are now selling 2.5 every three decades.

In this vein, I believe it's ridiculous for anyone to take out a thirty year mortgage. Okay, maybe it's not completely ridiculous, but what home buyers should probably be looking at is the comparable 15 year fixed mortgage payment. Allow me to illustrate.

Today, a 200k fixed-rate loan at 6% for thirty years would cost $1,200 per month.

The same loan on a 15 year term would cost $1,688 per month.

If $1,200 is the monthly payment you're comfortable with, then reverse-plug it back into the

mortgage calculator to see how much it'll allow you to borrow on a 15-year fixed-rate loan.

It turns out, with a fifteen year loan, $1,200 per month will only borrow you $142,000.

Mind you, that's on a non-jumbo sized loan.

If a larger borrower took my advice, instead of taking a 600k 30-year mortgage out, they would reduce their home buying budget proportionately - by $174,000. In this case, if they wanted to be debt-free in 15 years, they'd reduce their intended mortgage to $426,000.

In my opinion, housing could easily see 1998 prices again because buyers are not only paying prices at the top of the historical range,

...they are underestimating the carrying costs, transactional costs, and they are of course assuming steady and gainful employment.

The only thing "steady" in

my life is the onslaught of higher monthly bills. Remember, I don't even own a money pit; nor do we have car payments or student loans to pay. Two kids all by themselves are budget busters. They consume more clothes, food, and money each year. They've increased our healthcare costs and introduced a "babysitter" budget that is also relatively new. Their education (whether outsourced or not) could easily cost a tremendous amount of money. Every young family's expenses are on the same, unavoidable, upward trajectory. AND I haven't even talked about inflation.

The fact remains, consumers have too long underestimated their future expenses and overestimated their earnings potential. A fifteen year mortgage makes a ton of sense because of all the new financial burdens that keep getting dropped in your lap. In fifteen years, my son will be going to college - at that point I'd like to be done paying for my house. Furthermore, how the heck do these maxed out, credit card-ramping, home equity-tapping

Morons think they are going to save for their own retirements?

Social Security?

Hah! Tell me another one.

Alright, time to sign out.

But I want to ask you people a question. If you daycare your kids at 12 weeks so both parents can work and you can afford the larger mortgage....if you justify it by claiming that daycare is good for the baby's "social skills"...

Don't be surprised when you're old and grey, collecting a Social Security spare change, have no savings to live on, and your spoiled, individualistic kids send you to El Cheapo Nursing Home. Even if they have the big house, and plenty of room for an 'old coot' they will still send you away. They will outsource care for you just as you did for them as daycare babies.

I can't count how many times in recent years I have heard people plop their aging parents in nursing homes, assisted living communities, or the

DNR House and quip, "Well, it's better for them

socially to be around their peers."

Behold the irony!

Even if you don't

teach your kids, they will

learn from you.