At the risk of sounding like a wacademic or Roe v. Wade Justice Blackmun, I would like to, for the sake of argument, posit my theory that,

The real estate market can be divided into 3 classes.

1) Homes under $500,000

2) Homes between $500,000 and $1,000,000.

3) Homes over $1,000,000.

People just aren’t buying $1,500,000 homes with adjustable or interest-only mortgages ergo that end of the market is not as directly sensitive to the low interest rates of the past few years. Most of the time, these multi-million dollar houses are being bought with appreciated real estate from tier 2).

Likewise, tier 2) homes are being mostly bought with appreciated tier 1) homes. I know several people that bought a house for 200k 5-6 years ago, have sold it for 500k, and rolled the proceeds into a 700-800k home – all the while keeping their mortgage about the same.

And of course the starter homes in tier 1) are bought with little money down and consequently need very large mortgages.

It follows that the starter homes are more sensitive to interest rates than homes over $500,000.

My contention is that low mortgage rates (and lower lending standards) are the main driver of tier 1) homes AND they account for all of the appreciation in the mid-tier and higher tier homes – as homeowners trade up.

This may or may not sound like a radical notion, but if it is true, then low end homes are the linchpin of the real estate market and demand special scrutiny.

I also contend that the starter homes (and condos/apartments) are the most inflated and therefore most likely to get hammered down to reality. Shortly thereafter, the more expensive homes will fall in domino-like fashion.

As I have mentioned many times, everyone has a self-serving canard about how there specific home is insulated from the rest of the market: Boomers moving south, "we live in an up and coming town", the college concentration in Boston, immigrant demand for homes, etc. I obviously completely disagree and think the falling tide will hit all boats. Just as the different price tiers of homes are interconnected, the same applies across regions.

Devil’s Advocate: What is your proof that the low end homes are most overpriced?

Thanks for asking DA.

1) They are being bought with the most leverage, i.e. negligible downpayments and risky adjustable mortgages.

2) It is very hard to trade down in this market. By that I mean selling your house and moving to a smaller home or condo. I know several empty nesters that have $1,000,000 homes and would like to downgrade but haven’t because the condos they look at are 500k, much smaller, and seemingly not worth the price.

3) Rental prices are so far out of line with sales prices that interest rate arbitrage will set in. I have already detailed the miniscule return (3.7%) my landlord is getting on our building and this is the case nationwide.

Why buy a rental property yielding less than money market funds?

The real estate perma bulls think that rents will shoot up to justify apartment building prices.

Keep dreaming.

You have to love how spastic around-the-clock Big Media is. Yesterday they were touting a bouncing real estate market with this headline.

Existing Home Sales Soar.

And then today the wind got knocked out of them.

New Homes Sales Fall 10.5%, Most Since 1997.

The real estate market really hasn’t gone down yet, but when it does, any “bounce” will be a selling opportunity.

The housing market likely peaked last May/June when my landlord made the jump to tier 3), paying $1,000,000 for my current home.

How did he pay for it?

By selling another rental property of course, using the so-called 1031 Exchange. In fact, he really had to scramble to find my building because things were that nuts last year and one only has 45 days to find another piece of property.

He sold his other building in Brighton in less than one hour – over the internet and sight unseen.

Real estate people just don’t want to take any money off the table. They are addicted to the casino and keep parlaying every winning bet.

This current softness in real estate is nothing. Mortgage rates haven’t even risen yet. Remember, they can rise regardless of where the Federal Reserve sets short term rates.

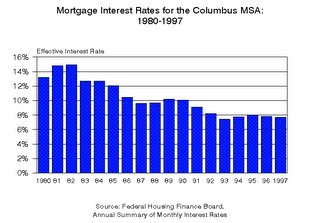

Here's a bit of scary recent history for the short memory crowd.

No comments:

Post a Comment