I can't stand these people that try to use Iraqi War deaths to buttress a most likely deeper criticism of the war.

My stock response is always, "Yeah, well over 100 Americans died in car accidents yesterday..."

Recently I had this altercation and the guy responded, "You may be an intelligent guy but that is a stupid thing to say." Then he "cut and ran" from the discussion.

Since that conversation ended, I will continue it here.

Devil's Advocate - I think what he is saying is that people die everyday for stuff like lung cancer and that doesn't mean we should ignore military deaths...

That's a bad example because lung cancer comes (mostly) from a self-destructive bad habit. I am just trying to put the deaths in perspective since Big Media does such a poor job of it.

Members of the military are paid volunteers doing heroic work AND they're fully aware of the risks of their choice. Their deaths are certainly tragic.

But for me, there is far more tragedy in someone dying simply on their drive home from work. If the numbers were closer it'd be a different story. But 3,000 military deaths in 3.75 years can't be compared to 160,000 auto accident deaths over that same period. There are substantially more widows and orphans created on American roads than in Iraqi deserts.

For most Americans, Iraq is an abstraction. If you don't know a soldier, turn on the news, or open a newspaper that war may as well not even exist. Bill O'Reilly said last night that the 15 minute segments of his show on Iraq are the least watched of his whole program. Many Americans like me just don't care. Thankfully I have the fast forward button of my DVR.

Devil's Advocate - So if you aren't there, then it's an abstraction? So was the Holocaust just an abstraction that people could justifiably ignore if they didn't know any Jews?

If there was a different Holocaust, forty times as big going on in America, then you could rightfully chock up Hitler's Holocaust as a trivial development in a far off land. My point is that auto accidents are such a more immediate danger to Americans than 7th century "insurgents" in Iraq. There are plenty of viable arguments against the war, but the number of military deaths doesn't even crack the top 100.

Almost every time I get in my car, I am toting my most prized possessions in life - my wife and two small children.

Of the five different cities I have lived in, Boston drivers are absolutely the most dangerous.

First of all, you have octogenarians in Oldsmobiles and Buicks driving everywhere. You know, modern society estranged them from their kids so they aren't living with them. Their kids won't confiscate their car keys because who'll then chauffeur the dinosaurs around? And as I mentioned in a previous post, they don't want to be cut out of the will - no matter how many kids their doting parents run over.

Watch the video and keep your eyes on the man crossing the street. The cause of the accident was cell phone yapping. It's horrid to think that that pedestrian got flattened because some self-centered bastard JUST HAD TO TALK TO SOMEONE...

People in Boston are all invariably yapping on their cell phones (not illegal yet), watching a dvd, text messaging, or driving with their dog on their lap like my neighbor.

Yeah officer, the only reason I ran over that little kid was because my little Fifi jumped up to lick my face. She is so sweet my little Fifi.

Remember this is a state that bans tag at recess because it's dangerous but it won't outlaw driver cell phone yapping.

Devil's Advocate - You are being over-dramatic about kids getting run over?

Am I? How would anyone know? Go try to find stats about the complicity of cell phones and car accidents. This stuff is confoundingly not reported. At the scene of any accident, drivers should be interrogated as to cell phone usage. It's easy enough to verify the call times from cell phone bills.

My peeves, as usual, are cemented by logic. I hate tailgaters and I hate right-lane highway speeders - they tend to be the dangerous weavers. I loathe drivers that imperil my safety; in fact I take it quite personally.

Off the highway, if you tailgate me, I will quickly glance at the mirror and profile your sanity. If you don't look like some gun-carrying lunatic, I will immediately hit the breaks and drive as low as 15 mph to teach you a lesson. Good luck trying to go around my massive Earth-scorching Chevy Suburban. Even if I am in a hurry, I feel duty-bound to self-sacrifice and teach the tailgater a lesson about appropriate driving distance and perhaps better personal time management.

I also can't stand these drivers on the highway that think coming within six inches of your fender is a normal way to ask you to shift right and let them pass. High beams from a distance are rude enough. Bear in mind that if I am driving 10 mph over the limit already, I feel no compulsion to switch lanes. No one is entitled to drive 80 mph. The highway is a dangerous place to have pissing contests but sometimes you have to push back provided safety permits.

When I was a child the government agents in "schools" erroneously taught us that a yellow light meant take to caution and slow down. Nowadays it means, hit the gas and fly through that intersection. See, I have been saying over and over again that teachers lie to the students!

This was in fact the cause of a car accident that destroyed my back almost 8 years ago. The traffic light turned yellow, and some geriatric in Philly misjudged how far from the light he was, hit the gas, and came barreling into the cab I was riding in. We had a green light and had just eased into the intersection at 21st and Lombard. Because he was accelerating, the fossil hit us so hard that both cars were wrapped around a telephone pole. They needed the jaws of life to get the Moron out of his car.

I could have been hurt far worse than I was so I hate to complain about my plight. But if you really loathe someone, wish a bad back upon them. A bad back pains physically AND psychologically. Every frustration or setback tortures your body as well as your mind. Always an intense hothead, now I have to exert constant effort on chi management. Perhaps one day I will write a positive post and expound some more on my techniques.

Boston is a self-described "tough town". But the cold climate, rudeness, and economic malaise do not chisel out "tough" citizens as people here like to think of themselves. It churns out egocentric *ssholes. Nowhere is it more apparent than on the roadways.

Let me walk you through the morass of Boston's driving/traffic problems.

First of all, the mass transit here sucks. The government does not encourage people to take the trains or buses. They won't build high rise apartments near train stations. You wouldn't believe the trouble West Roxbury gives to anyone who tries to build an apartment or two near its train station. They want traffic studies, environmental studies, etc. They have old people in town who still drive down Centre Street to mail a letter or buy groceries 3 times a week and don't want any more "traffic". As a result, no young people live downtown and therefore you can forget about a vibrant market for bars, restaurants, or other commercial development. The lack of high rise apartments precludes a critical mass of residents, which would otherwise energize the local economy and put a dent in commuting traffic. Centre Street in West Roxbury is one of the most pathetic dilapidated main streets I have ever seen - 5 miles from Boston no less (only 22 minutes on the train). No normal young people would ever consider living there as it stands.

But that's not the only side effect. Since there is no way to live near a train station, everyone has to scatter about, own a car, and drive everywhere. See how these things spiral out of control? Arguments to discourage "traffic" invariably make it worse.

Last year, gasoline crossed the $3 dollar level and likely tempted many drivers to think about taking mass transit to work. A good thing right? Well the Massachusetts government apparently wanted to forestall that - they raised fares across the board. Subway fares are going up the most - 36% next month. They claim the fare hikes are required by law. The MBTA is hiding behind a "legal requirement" to balance their budget.

Bet your bottom dollar that the budget is in the red because of unions. Remember, environmentalism ALWAYS plays second fiddle to socialism - a lesson Greg Mankiw would be wise to digest.

Alongside the octogenarian driver is the more dangerous teenage/college punk driver. There are scores of them and not just because of the socialist/environmental zoning restrictions that force everyone into car-dependent lifestyles. Remember, Massachusetts is a full-blown Communist bastion. Under the shibboleth of equality, the Commonwealth will not let auto insurance companies price discriminate on very important factors. Generically speaking, they can't discriminate based on age or geography no matter what actuarial risk profiles demonstrate. Consequently, young drivers pay the same premiums as safer, older drivers; and rural drivers have to ante up just as much as more accident prone city drivers.

Devil's Advocate - This isn't fair?

Not only is it not fair, it's very dangerous. Why should older, safer drivers in rural Western Mass have to subsidize lane-weaving college kids in Boston? It befuddles the mind why at least half of the state's representatives haven't risen up in arms to protest this price distortion. Their deafening silence implies at least a fear of Boston-based pols and at most a stark ignorance of economic reality. The study I read concluded that car insurance is, on average, $150 higher than it would be if insurers were free to "discriminate" just on age and geography. Allowed to charge the accident prone their fair premiums, fewer urbanites and fewer youths will be on the roads.

Why does Mass have this policy on geographical discrimination? Who knows? I believe it's because they don't want minority Dorchesterites to be paying more than the bluebloods in Chestnut Hill. Or maybe it germinated from the power of Boston pols who just wrested cheaper car insurance for their constituents. When I lived in Philly, a friend of mine was given his father's BMW. He called for an insurance quote, for a new BMW , parked on the street in Philly, driven by a 23 year old. They told him insurance would be 7k per year. Needless to say, that BMW never made it down to the City of Brotherly Love. He took the subway and cabs instead.

Whatever the original motivations or ongoing justifications, free market meddling in the name of "equality" remains socialism with all of its attendant negative externalities. Here it goes beyond just higher prices and lower efficiency because people not so infrequently die in car accidents.

Now back to my "cut and run" critic who thinks I am a fool to talk about highway deaths. He doesn't have any kids to worry about or to make him drive a little bit safer. I suggest he think about OTHER PEOPLE'S KIDS or even his own health. Over one hundred people per day die in car accidents; maybe the number isn't significantly reducible but I highly doubt it. The fact remains, nobody is studying the issue; we are all just supposed to become inured to it - I guess.

My theory is that there is a sub-population of dangerous drivers out there, not very hard to identify. They will be the ones that at some point end up injuring or killing somebody. Surely, everyone knows a few acquaintances that drive like lunatics. People either yap on the phone, speed, tailgate, and weave all of the time OR hardly ever at all. I think they need unmarked police cars out there mounted with cameras to get these specific jackasses off of the roads. Also we need better mass transit, fairer "discriminatory" insurance pricing, and a deregulated cab industry - please don't get me re-started on the cabs.

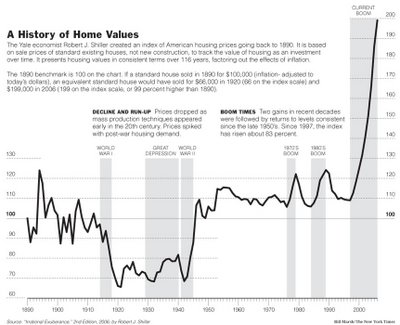

Bad driving is taken too lightly by almost everyone. Just accept it because it's far worse in other countries? I don't think so. Around 400,000 people have been killed on the roads in just the last 10 years. It is a present day mini-Holocaust.

And that 400,000 number isn't counting all of the broken backs, limbs, and vegetative comas wrought by car accidents - a number likely much larger.

I could be wrong, but I think it's possible to get driving deaths down to say 90 per day rather than current 115 and climbing.

Recently a college classmate of mine and his wife were killed in an auto accident, orphaning their infant daughter. Some guy of dubious immigration status drove across a wide grassy median on the highway and caused the tragic pileup. There was no sign of drugs or alcohol. The guy either fell asleep, was talking on his cell phone, or guilty of some other distraction. The news of this accident was broadcast widely all over New York (of course without the messy illegal immigrant angle). What real life example of most families' worst nightmare wouldn't be?

My wife knows three kids from her high school that were killed ON BICYCLES by automobiles.

A former co-worker of mine came home to the most horrible phone call one day. His wife and fourteen year old son were killed in an accident on the way home from lacrosse practice.

I knew a ten year old child who chased a ball into the street, only to be run over by a passing car.

Think for a moment. How many auto deaths have hit close to your home? That number will only go up.

Some Morons vote for socialists, but others may get distracted by Oprah or SportsCenter and run you over on the street, regardless of whom they voted for.

Be wary of them all.

UPDATE

Hello jalopnik readers!!!

Sorry to disappoint but your webmaster misled you. Nowhere in my post did I insist that deaths from cell phone yapping drivers are worse than the Holocaust. Either he reads too fast or thinks too slowly.

I hope he's got a better grasp of cars than he has of basic reading comprehension!!!