Yesterday, in - EVERYONE Should Quit Trading! - I briefly discussed Goldman Sachs and their so-called *proprietary trading*.

For more on that subject, read this insightful piece:

The frog, the scorpion and Goldman Sachs.

As part of a $133 million renovation, the General Services Administration is planning to cultivate "vegetated fins" that will grow more than 200 feet high on the western facade of the main federal building here, a vertical garden that changes with the seasons and nurtures plants that yield energy savings.

"They will bloom in the spring and summer when you want the shade, and then they will go away in the winter when you want to let the light in," said Bob Peck, commissioner of public buildings for the G.S.A. "Don’t ask me how you get them irrigated."

The G.S.A. says the building will use 60 percent to 65 percent less energy than comparable buildings and estimates a savings of $280,000 annually in energy costs. Solar panels could provide up to 15 percent of the building’s power needs. The use of rainwater and low-flow plumbing fixtures will reduce potable water consumption by 68 percent. And energy for lighting will be halved.

"It will be one of the more energy-efficient high-rises in America, possibly in the world," said James Cutler, whose architecture firm, Cutler Anderson, led the design work.

This type of divergence will lead a very powerful and very sharp sell off that even I may not be able to fully profit from it, despite the fact that I am the one seeing it, living it, breathing it right now. It will start in such a way that will trap the maximum number of traders on the wrong side and leave bears out of the move.

It will start in a way that the initiating move will erase all the cumulative gains one can possibly make trading this silly range during the last 2 months.

I am very confident about all these, but what I am not confident about is the sit tight part I have to do. Once this thing begins, believe me, the best way to profit from it is to shut down your computer and let your short positions stay for 5-10 days because the move will be perpendicular.

Like I said before, I don't know the exact time or place it will start but I know it will start in a week or so and it will be initiated somewhere within this range.

But now, time to get cautious on the downside.

Yes there is massive down volume, all your oscillators are pointing to down, DMAs are turning but the only thing that matters is controlling trends.

Market will likely reverse to higher on Monday or early Tuesday from approximately where it closed on Friday. There are intermediate and short term TLs being tested across the indices.

This doesn't mean we may not see lower prices or some sort of flush. We possibly will but it will be tricky.

Jobs, characteristically, did not mince words as he spoke to the assembled, according to a person who was there who could not be named because this person is not authorized by Apple to speak with the press.

On Google: We did not enter the search business, Jobs said. They entered the phone business. Make no mistake they want to kill the iPhone. We won’t let them, he says. Someone else asks something on a different topic, but there’s no getting Jobs off this rant. I want to go back to that other question first and say one more thing, he says. This don’t be evil mantra: "It’s bull$hit." Audience roars.

About Adobe: They are lazy, Jobs says. They have all this potential to do interesting things but they just refuse to do it. They don’t do anything with the approaches that Apple is taking, like Carbon. Apple does not support Flash because it is so buggy, he says. Whenever a Mac crashes more often than not it’s because of Flash. No one will be using Flash, he says. The world is moving to HTML5.

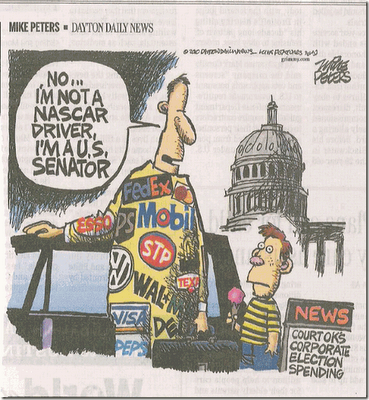

President Obama stepped up the heat on big banks Thursday, saying he would fight to ensure that their "binge of irresponsibility" never happens again.

He proposed limits on banks' size and proprietary trading and said he would work to "rein in excessive abuse that brought down our system."

He said banks "backed by the American people" shouldn't be allowed to own or sponsor hedge funds and private equity funds for their own profit, while putting customers at risk.

....implementation is challenging. As a student of the market I can tell you that it all blurs together...

Jan. 29 (Bloomberg) -- Russia urged China to dump its Fannie Mae and Freddie Mac bonds in 2008 in a bid to force a bailout of the largest U.S. mortgage-finance companies, former Treasury Secretary Henry Paulson said.

Paulson learned of the "disruptive scheme" while attending the Beijing Summer Olympics, according to his new memoir, "On The Brink."

The Russians made a "top-level approach" to the Chinese "that together they might sell big chunks of their GSE holdings to force the U.S. to use its emergency authorities to prop up these companies," Paulson said, referring to the acronym for government sponsored entities. The Chinese declined, he said.

"The report was deeply troubling -- heavy selling could create a sudden loss of confidence in the GSEs and shake the capital markets," Paulson wrote. "I waited till I was back home and in a secure environment to inform the president."

Russia sold all of its Fannie and Freddie debt in 2008, after holding $65.6 billion of the notes at the start of that year, according to central bank data. Fannie and Freddie were seized by regulators on Sept. 6, 2008, amid the worst U.S. housing slump since the Great Depression.

Paulson said he was surprised not to have been asked about the Fannie and Freddie bonds during a trip to Moscow in June. "I was soon to learn, though, that the Russians had been doing a lot of thinking about our GSE securities," he said of his meeting with Dmitry Medvedev, who succeeded Putin in the Kremlin the previous month.

The approval process was for the underwriter to run the loan through DU/LP and if the system did not issue an approval (or an approval the borrower and the loan officer were happy with) to go back into the input file and edit the income, assets, retirement (or all three) until the system approved it. Some loans were edited 30 or 40 times until the system issued an approval.

All morons hate it when you call them a moron.